LIFEPOWR has raised €5.65 million to push its virtual power plant tech deeper into Europe’s fast-growing energy market. The Antwerp-based company, active since 2015, is doubling down on one of the biggest challenges facing the continent today: keeping the grid stable as renewable energy adoption accelerates.

The round was led by Noshaq and SPDG, with participation from ROM InWest and several existing shareholders. This new capital gives LIFEPOWR the resources to speed up product development and expand into more European regions at a time when flexibility is becoming essential for both consumers and the grid.

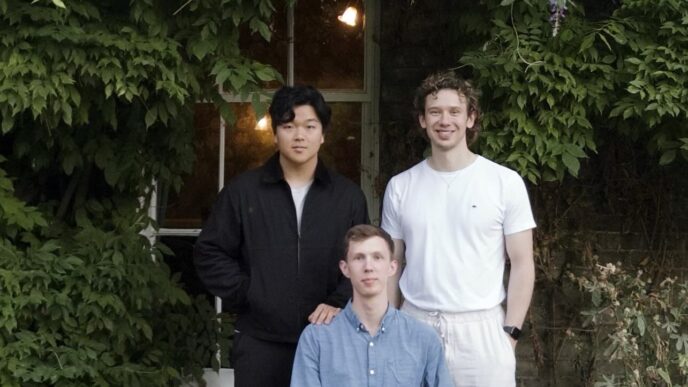

The company was founded by Dries Bols with a simple idea that has grown into a powerful mission, turn prosumers into active players in the energy transition. Instead of relying only on large power plants, LIFEPOWR connects thousands of distributed assets and helps them work together like one intelligent virtual power plant.

Its FlexiO platform sets the company apart. It uses advanced EMS+ software and real-time, AI-powered market intelligence to decide when to store, use, or sell energy. This automatic orchestration lets households and businesses lower their energy costs while helping energy providers balance the grid more efficiently.

The approach differs from players like Next Kraftwerke, Flexcity, and Nano Energies. LIFEPOWR brings flexibility management, value optimisation, and direct prosumer access to energy markets into one unified system. This makes FlexiO not just a management tool, but a complete market gateway for both users and energy partners.

With fresh funding secured, LIFEPOWR is gearing up for expansion. The Netherlands is the next major step, followed by other key European markets where grid instability and rising renewable penetration create urgent demand for smarter energy systems.

The company currently manages more than 22,000 connected assets. Its network of resellers, white-label partners, and energy providers continues to grow as more organisations integrate FlexiO to modernise their offerings. LIFEPOWR plans to scale its team of energy experts and broaden its partner ecosystem as it builds toward a cleaner and more flexible energy future.

Another tailwind for LIFEPOWR is regulation. Across Europe, grid operators and policymakers are actively encouraging flexibility solutions to avoid costly infrastructure upgrades. Virtual power plants are increasingly seen as a faster and cheaper alternative to reinforcing grids. LIFEPOWR’s model fits neatly into this shift, allowing regulators and utilities to unlock flexibility that already exists behind the meter.

The timing is also strategic for prosumers. Volatile energy prices and dynamic tariffs are pushing households and businesses to think more actively about when and how they consume electricity. By automating those decisions, FlexiO removes complexity while still letting users benefit financially. That ease of use is becoming a key differentiator as energy management tools move beyond early adopters.

Looking ahead, LIFEPOWR sees virtual power plants as foundational infrastructure for Europe’s energy system. As electric vehicles, heat pumps, and battery storage continue to scale, the number of flexible assets will multiply quickly. Coordinating them manually will be impossible. Platforms that can orchestrate millions of small decisions in real time will define the next phase of the energy transition.

With funding secured, technology in place, and expansion underway, LIFEPOWR is positioning itself to play a central role in that future. By turning decentralised energy into a coordinated market force, the company is helping reshape how Europe produces, consumes, and balances power at scale.

There is also a competitive urgency driving adoption. As more energy providers roll out flexibility services, early movers gain access to better market positions, data, and customer trust. LIFEPOWR’s growing footprint gives it a head start in aggregating assets at scale, which becomes harder for late entrants to replicate. That aggregation advantage could turn into a powerful moat as Europe’s energy markets shift from centralized production to coordinated, software-driven systems.