Midi Health has secured $50 million in fresh funding, a new milestone for the fast-growing women’s health startup betting on longevity and AI. The Series C round was led by Advance Venture Partners and closed quietly in the spring, bringing the company’s total funding to roughly $150 million.

Cofounder and CEO Joanna Strober confirmed the raise and said the company is now operating at a $150 million revenue run rate. That is more than double what it reported at the end of 2024, showing how quickly demand for midlife women’s health services is accelerating.

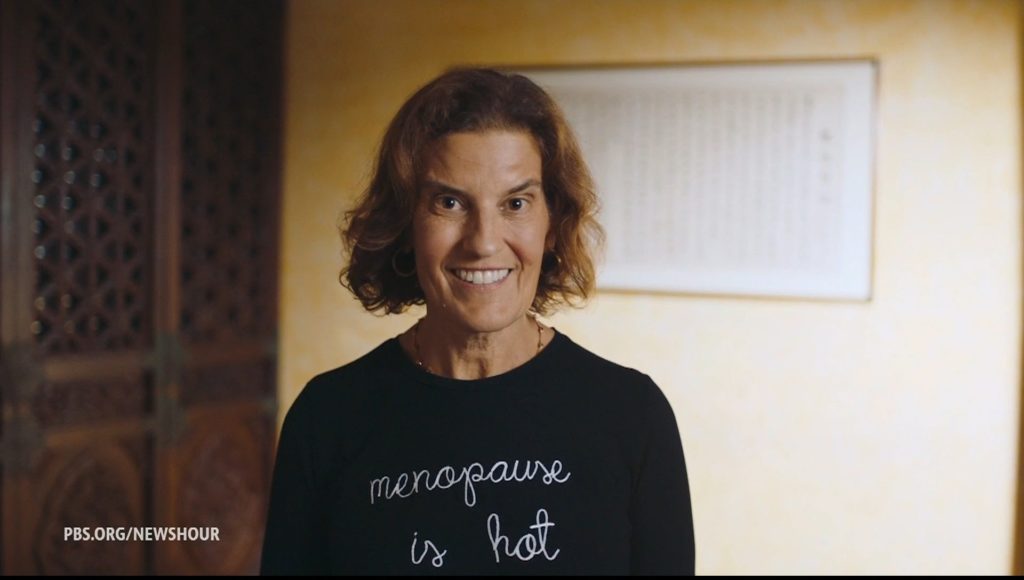

The startup launched in 2021 and has raised more capital than any other menopause-focused company to date. Its rise mirrors a much larger market shift. Employers are adding menopause care to their benefits. Investors are finally backing women’s health. And a topic once treated as taboo is now entering mainstream conversation, helped along by public figures and new research.

Midi’s model centers on personalized care for perimenopause, menopause, and other midlife conditions. Treatment plans may include hormonal or non-hormonal medications, genetic and blood testing, supplements, and lifestyle coaching. The company is now treating about 20,000 women each week, which is nearly twice the size of its patient base from January.

As the business expands, Midi is leaning into two big bets. One is longevity care. Earlier this year, it rolled out a new program designed to help women reduce long-term health risks around heart disease, cancer, brain health, and bone strength.

The second is AI. Midi is developing its own AI-powered women’s health search engine, designed to work like a vetted, medically reliable version of ChatGPT. Strober said many existing tools surface outdated or incorrect information, which can be dangerous for women trying to understand key health decisions. Midi wants to offer a safer alternative with deeply curated sources and consistent quality.

Strober has openly criticized some medical search tools, including OpenEvidence, arguing that they fail to prioritize the most accurate or recent research. That debate resurfaced after a LinkedIn post she wrote was cited in a lawsuit involving Doximity and OpenEvidence.

Advance Venture Partners is backing Midi for the first time in this new round. Earlier supporters include Emerson Collective, GV, and 23andMe cofounder Anne Wojcicki. Midi did not disclose its current valuation, though it previously raised $60 million in 2024 at a valuation of about $300 million.

The broader menopause movement is gaining traction. Celebrities like Halle Berry and Amy Schumer are pushing education and awareness. Regulators are also stepping in. The FDA held an expert panel earlier this year exploring whether warning labels on low-dose estrogen treatments should be softened, as some doctors argue the current labels discourage necessary care.

Investor interest is rising along with public attention. Women’s health startups still make up a small slice of the market, but total funding grew 55% last year to reach $2.6 billion, according to Silicon Valley Bank.

Longevity is another booming sector that Midi is stepping into. The market is full of high-profile initiatives, from biotech companies like Retro Biosciences, backed by Sam Altman, to consumer platforms like Function Health. Many of the loudest longevity advocates tend to be men in the “biohacker” space, but Midi is taking a slower, evidence-based approach tailored specifically to women.

Strober said the goal is not to chase extreme optimization trends. Instead, the company is focused on practical, clinically supported interventions that support long-term health without overwhelming patients.

Most of Midi’s virtual care services, including its new longevity visits, are covered by major commercial insurers such as UnitedHealthcare, Cigna, and Aetna. The company does not accept Medicare or Medicaid plans.

Despite its momentum, Midi faces rising competition. Digital health giants like Maven Clinic offer their own menopause programs. Newer entrants such as Elektra Health are gaining attention. Amazon’s One Medical also rolled out menopause care across its clinics. And in the longevity space, Midi now overlaps with Function Health and other preventive-care startups targeting similar demographics.

Midi plans to invest its new capital into improving its technology and scaling its clinician workforce. Strober said many OB-GYNs are not properly trained in perimenopause and menopause care, so the company has created its own intensive training program that blends women’s health and primary care best practices.

The company is also restructuring its leadership team. Midi is currently without a CFO after the departure of executive Brandon Poe this summer. Strober declined to discuss the exit but noted that newly hired COO Amy Gershkoff Bolles has significant financial experience and is handling much of the CFO workload until a permanent replacement is found.

Despite not being profitable yet, Midi believes it has a clear route to profitability as demand for its services continues to scale. Strober is cautious about selling the company, saying that an acquirer might not take the mission as seriously as she and her team do. For now, she intends to keep building the business independently.