Monarch, a San Francisco-based personal finance app, has secured $75 million in Series B funding, pushing its valuation to $850 million. The round was led by Forerunner Ventures and FPV Ventures, marking one of the most notable consumer fintech deals in a year where investor appetite has cooled.

Monarch’s rise comes at a pivotal moment. The shutdown of Mint, once the dominant personal finance platform, left millions of users without a trusted tool to manage their money. That gap created an opening—and Monarch was ready to fill it.

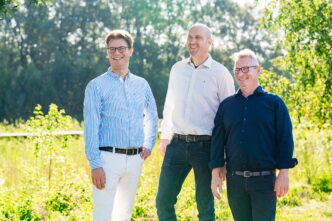

Founded in 2018 by Val Agostino, a former Mint product lead, alongside Jon Sutherland and Ozzie Ozman, Monarch had long been building an alternative focused on user trust, subscription value, and a clean design. But Mint’s closure in early 2024 acted as a catalyst. Over the past year, Monarch’s user base has reportedly grown 20x, with 9% weekly subscriber growth.

Unlike Mint, which offered a free service funded by ads and credit card affiliate deals, Monarch launched from day one with a subscription-only model—$14.99 per month or $89.99 per year. The company promises no ads, no selling of user data, and a platform that does more than track spending. Users get budgeting, investment tracking, financial goal setting, AI-driven insights, and collaborative tools for couples and advisors—all in one unified app.

This bold, privacy-first approach has resonated. As millions of former Mint users look for a new home, Monarch offers something rare in the fintech world: transparency, polish, and alignment between business model and user success.

Standing Out in a Crowded and Cautious Market

The personal finance space is notoriously competitive. Dozens of apps claim to help users budget, invest, or save. Yet most either offer free tools with hidden tradeoffs or sit at the premium end with steep price tags and complex onboarding. Monarch lands squarely in the middle—and that’s its strength.

Wesley Chan, co-founder of FPV Ventures, compared Monarch to Canva, calling it a platform that simplifies complexity and empowers the average user. Onboarding is smooth, expense categorization feels intuitive, and the UI is designed to reduce friction—critical in a market where financial literacy gaps often lead to user drop-off.

Investor SignalFire even described Monarch as a potential “operating system for personal finance,” capable of becoming the backbone for how people track and manage their financial lives.

In today’s digital world, where every “free” tool often comes at the cost of your data, Monarch’s ad-free, pay-to-play model is refreshing. The pressure to deliver is higher—if users don’t see value, they cancel—but that’s what keeps the product evolving quickly and honestly.

This user-aligned model is key to Monarch’s high retention and word-of-mouth growth. As more consumers reject ad-based monetization, they’re looking for tools they can trust—and Monarch is betting big on being that platform.

A Rare Bright Spot in Fintech Funding

Consumer fintech has been hit hard in recent quarters, with many startups struggling to maintain growth or raise new capital. Monarch’s $75 million raise is a rare win. It shows that when product, timing, and traction align, investors are still willing to back bold plays.

Other recent fintech standouts—like Felix, which focuses on money transfers for Latino immigrants—show that niche players can still win. But Monarch’s appeal to a general audience gives it a broader runway.

The collapse of Mint, and Intuit’s suggestion that users switch to Credit Karma (which lacks Mint’s core budgeting tools), created a “perfect storm” that accelerated Monarch’s rise. And with millions still searching for a robust replacement, the opportunity is far from over.

With its new funding, Monarch plans to grow aggressively. That includes expanding the team, deepening financial integrations, and continuing to enhance its platform with more personalized financial planning tools. The goal: to become not just a budgeting app, but a central hub for financial well-being.

As co-founder Jonathan Gass puts it, financial stress is the leading cause of anxiety, relationship strain, and even mental health issues. Monarch’s mission is to change that by helping people build a healthier, more intentional relationship with money.

And with a clean interface, clear pricing, and no data exploitation, Monarch isn’t just competing with other apps—it’s redefining what a personal finance platform can be.